Is Vaping Cheaper Than Smoking?

18th Apr 2024

We're in the middle of a financial living crisis. If you live in the UK and currently smoke, the price of tobacco products has never been higher. The prices of many products in the UK are going up, so any method to save and see more in the bank balance is always positive!

With smoking numbers declining year on year, has vaping helped with that shift? Questions regarding the cost of e-cigarettes and whether vaping is cheaper than smoking is the reason you’ve landed on this blog.

So, let’s breakdown the overall cost of a vape kit and whether this switch could not just benefit your health with no more combustible tobacco but also save you more money to feel at ease during the cost-of-living crisis.

What was the Cost of Cigarettes in 2024?

It’s no surprise to see that the UK government has announced a further increase on tobacco products for 2024 to raise awareness of the dangers of smoking.

This is in the shape of a ‘one-off’ increase of £2 per 100 cigarettes, or 50 grams of tobacco, which takes effect two years from now (October 1st, 2026).

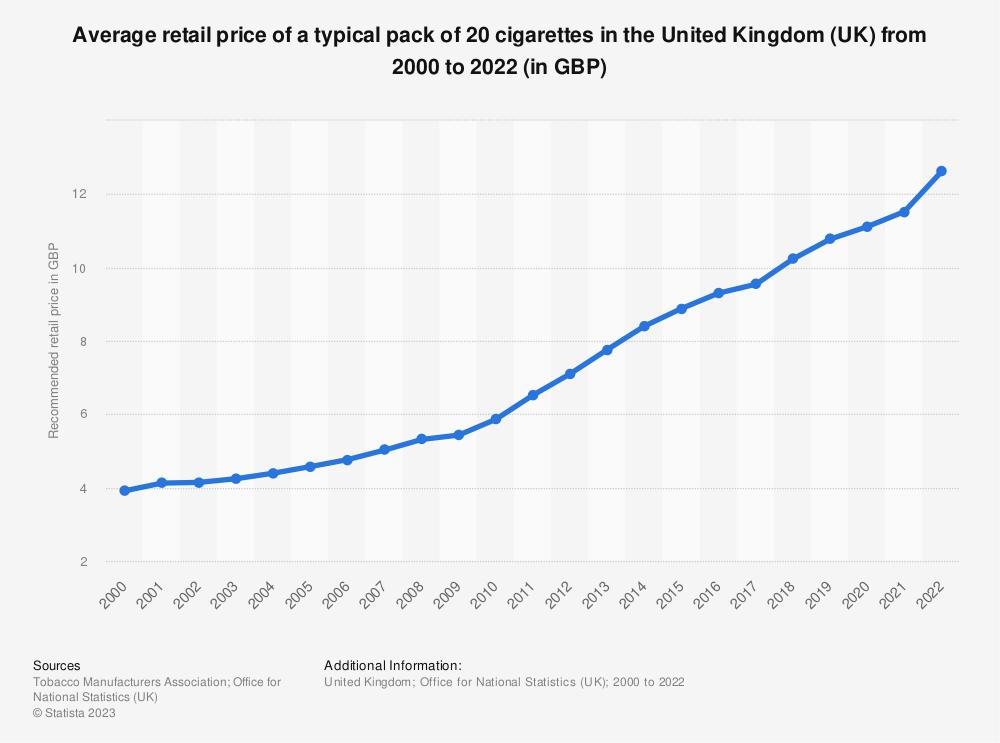

At the start of 2023, the average price of cigarettes according to the National Office for Statistics in January 2023 was £12.84. With the 12% increase declared in the budget, this quickly rose to a whopping average price of £14.39 (or 71p per cigarette in a pack of 20).

Because the price of an average pack of 20 cigarettes rose by 95p for last year’s budget, based on the 2024 announcement, this adds on an extra 40p per traditional pack of 20.

The duty rates on all tobacco products indicated by the Retail Price Index (RPI) of 10.1%, plus 2%, impacts not just the price of a pack of 20 cigarettes but the average smoking habits in the UK today.

|

|

Over the past two decades, there has been a steep increase on the retail price of cigarettes, which has meant financial struggles as well as health struggles (both physically and mentally) for roughly 12% of the UK population, that still smoke. The good news is we’re seeing a steadily decline in the interest of cigarettes, partly thanks to e-cigarettes as an alternative cessation tool, according to statistics from the latest Action on Smoking and Health (ASH) study.

Following the announcement of the increase in tobacco duty rates, this will also likely mean a further jump in the price of cigarettes for individuals from 2026, which will hit heavy smokers and the unemployed the hardest. But interestingly, there is a two-year gap between now and then.

Is Vaping Cheaper in 2024 Than Smoking?

While the government is keen to present to the UK public with elections looming that vaping will be cheaper than this one-off tobacco duty increase, they have also announced a new duty on vape products (also 1st of October 2026).

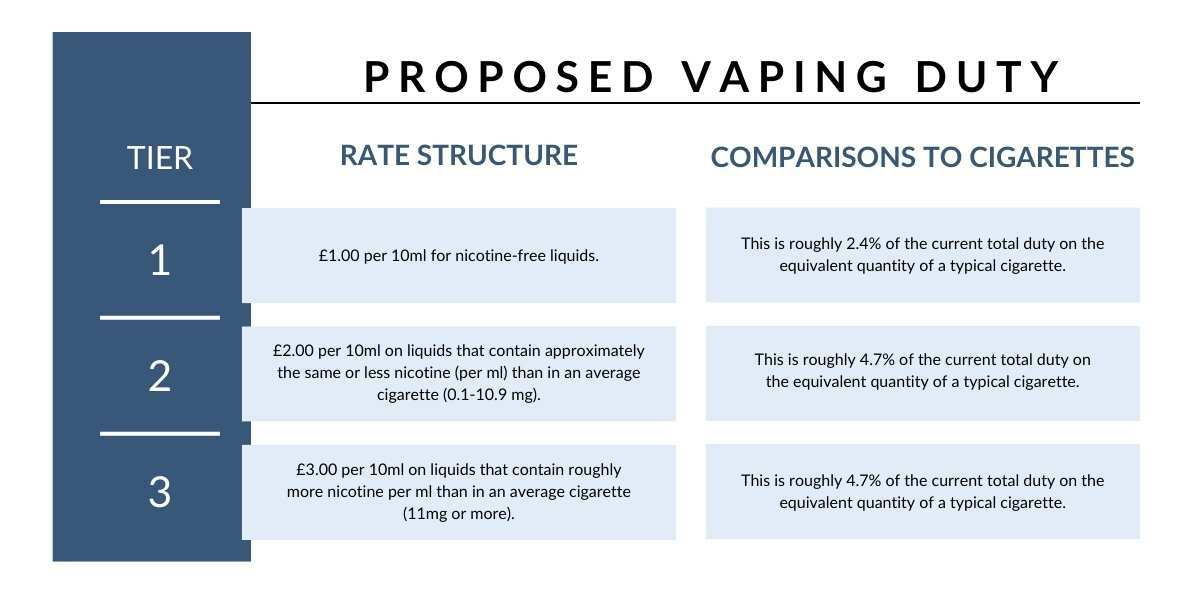

Pending a consultation, which will last for 12 weeks to the end of May, there could be significant changes to e-liquid and shortfill prices – with and without nicotine – which are highlighted in the table below created by HMT/HMRC.

With these proposed prices in mind, it will certainly mean a huge increase in price for anybody who buys 50ml or 100ml shortfills without nicotine.

From the early suggested tax tier structure, it appears to cost less to vape higher nicotine strengths.

Because the UK government is very keen to see their Smokefree by 2030 plan come to fruition, several intended measures were announced by UK Prime Minster Rishi Sunak towards the end of 2023 and by Chancellor Jeremy Hunt in the latest Budget. This included increasing the smoking age annually by one year so eventually nobody can buy them, which is fantastic news!

Here is what Hunt said about the proposed tax duties:

“To discourage non-smokers from taking up vaping, we are today confirming the introduction of an excise duty on vaping products from October 2026 and publishing a consultation on its design.

Because vapes can also play a positive role in helping people quit smoking, we will introduce a one-off increase in tobacco duty at the same time to maintain the financial incentive to choose vaping over smoking.”

The reasoning behind the duty on vapes alongside the one-off increase in tobacco duty is threefold – to curb youth vaping, deter smokers further and help to ease the burden on the NHS. It’s expected to raise a combined £1.3 billion by 2028/29.

What Did the UK 2024 Budget Mean for Vaping Costs vs Smoking?

Well, there has been some seismic shocks in the vaping and smoking industries on the back of the 2024 budget announcements!

What there tends to be with vapers is three types – your disposable vapers, which will no longer exist from April 2025 following the ban, those who seek a similar convenience so go for a more sustainable prefilled pod or cartridge vape pen, or the most financially savy who try shortfills or refillable e-liquid pods and tanks.

However, the proposed Budget announcement on duty tax and pending disposable ban will see another big shift in the industry.

Any vaper who thought vaping shortfills could save them money in the long run, which is essentially combining a nicotine shot of 10ml/20ml with a 50ml or 100ml nicotine-free e-liquid respectively will be out of pocket. Shortfills tend to be priced at £10+ and a £1 increase per 10ml for nicotine free e-liquids will mean a total cost of £15 just for a 50ml without a nicotine shot!

This could essentially price you at the same price as a pack of 20 cigarettes, although a shortfill e-liquid should last considerably longer depending on vaping habits.

How Much is a Vape?

So, this leads us nicely to the next big question, how much is a vape device and all its accessories?

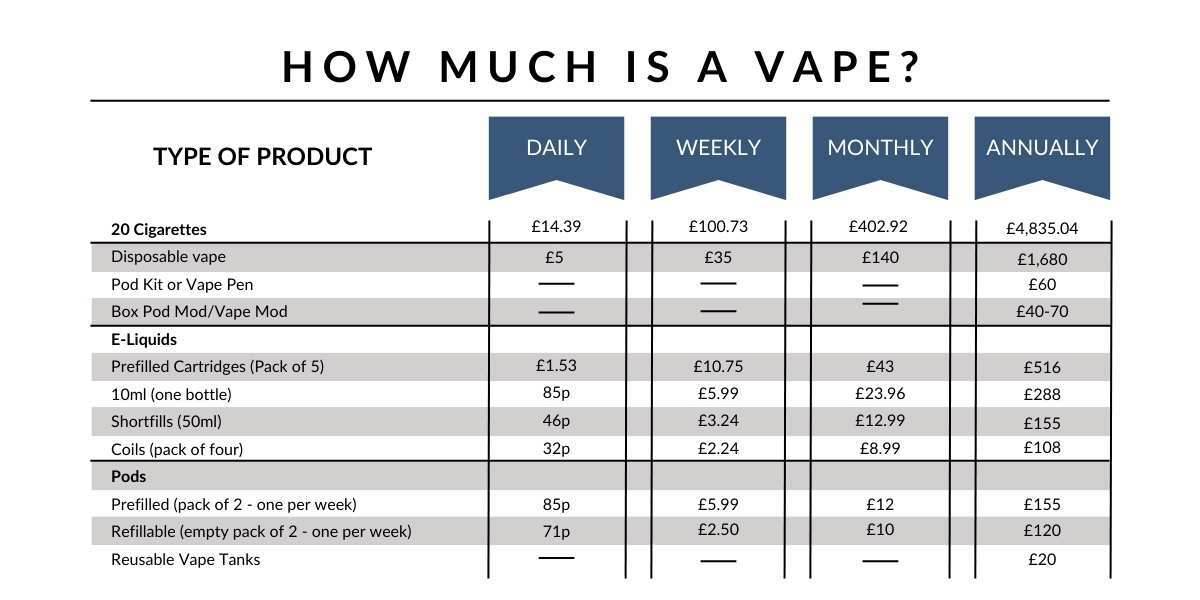

Similar to smoking cigarettes, the cost of vaping can vary depending on the individuals' habits. The price of an e-cigarette, including all of the frequently needed extras like e-liquids, coils, pods/tanks may look dearer.

However, in the long run it’s still significantly cheaper than smoking, as highlighted in the table below.

Factors such as how much you smoked previously, your goals for your smoking cessation journey with the help of vaping and your budget all matter. When you consider too that each type of vape kit has a different setup also plays a factor in the cost.

How much you annually spend will depend on your preferred initial method, how much time you want to spend and your chosen strength of nicotine.

With disposable vapes, once it’s empty, you responsibly dispose of the product and pick up another. Disposables are ideal as an entry level device and are usually made for heavy smokers with the highest nicotine salt strength of 20mg.

The higher price long term is reflected in the convenience, which makes disposables so handy as an entry level device for adults looking to quit and seeking a simple transitional first vape, with no complications. It doesn’t need extra coils, e-liquids or additional pods, because it’s a single use device.

But should you truly want to save money, a refillable and rechargeable vape kit will be the cheapest option. The first price of the device (illustrated above) will be higher than one packet of cigarettes. However, it should last you between 3-12 months depending on the level of care from the user and the manufacturer’s reputation, as well as build quality.

Once you have paid that first outlay, the only regular costs will be e-liquids, coils and tank/pod replacements. You can recharge a pod kit, vape pen, or vape mod.

E-Liquids

A 10ml bottle of liquid will refill a TPD-compliant 2ml tank or pod (the max allowed) fully five times. You can even buy bigger bottles called shortfill e-liquids which contain no nicotine and are sized at 50ml and even 100ml. So, you can vape nicotine free to keep up the sensation or add a nicotine shot for a low milligram concentration.

The average vaper will get through around 10ml of e-liquid per week, which is about £7 for a high-quality vape juice like the V2 Vsavi Platinum range. That’s £364 per year on e-liquids, a fraction of the cost of smoking! Even if you’re a heavy vaper and spend double this on e-liquids, the monthly cost of your e-liquid will still only be around £56, compared to the 250 pounds per month that smokers will spend on cigarettes, as estimated by ASH.

Vape Coils

You may also need to pick up certain accessories and parts for your vape on a semi-regular basis. For those of you using vape mods and more advanced e-cigarettes, you’ll need to change your coils regularly. The coil is the part of your vape that heats up to create vapour from your e-liquid and should be replaced, on average, every two weeks, though this varies depending on how often you vape and the kind of device you have.

Vape coils cost around £12 for a pack of 5, depending on the brand you select. The life of a vape coil depends on how well you take care of them in use, priming them correctly before vaping to maintain a good working order - swapping every week or two before they get a burnt taste.

Pod or Tanks

A pod or tank stores the coil and the e-liquid chamber - which you would need to fill on a regular basis. As set by the Tobacco Products Directive (TPD) regulations, no tank or pod in the UK can hold more than 2ml of e-liquid at a time, which is designed to limit the amount of nicotine you consume in one go.

Pods are aimed more at beginners because they’re are convenience personified, with simplistic designs and setup to allow quick hassle-free filling of e-liquids.

You can get mouth to lung (MTL) tanks for vape pens or some pod kits, but most tanks are tailored towards DTL vaping, offering more power and airflow control for bigger clouds of vapour.

Other Accessories

You may need to replace your batteries at some point as well. This can be every three months for smaller, less expensive devices or only every 18 months or so for a quality vape model. Batteries can cost anywhere from £10-20, so in the interest of fairness, let’s call it £15 every six months.

It’s even better if you have an internal battery to charge, which saves on the price of batteries, but will cost you more in running electrical costs at home. And will also mean needing to wait and charge the device while out and about but in need of a vape.

Other accessories you will need includes a type-c USB charger, which most companies give you anyway as part of the vape kit, but you’ll often have one lying around the house for other electronic devices that should charge the device just as easily anyway.

Check out our calculator tool to understand how much you could save by quitting smoking and switching to vaping.

Top tip for added savings: Sign up for promotional emails and follow your favourite vaping companies' social media accounts to get the best deals offered on holidays and events such as Black Friday or Stoptober.

Costs of Smoking to the UK Economy and NHS

Despite the rise in popularity of vaping, costs of smoking to the NHS are still high with more than 6.9 million adults over the age of 18 smoking in the UK. A 2015 study estimated that the cost to the NHS of smoking was a massive £2.6 billion! Although it has dropped to £2.5 billion in the latest 2019 study, that's still dangerously high on a stretched budget already affected by Brexit.

|

|

How We Can Help at V2 Cigs UK

To find out more about how vaping can help you cut down nicotine and quit smoking for good, look at our range of excellent beginner vape kits for smokers or get in touch with our customer service team to see how we can help you get started on your vape journey!

Read our disclaimer on Vaping and Smoking Cessation

|

|